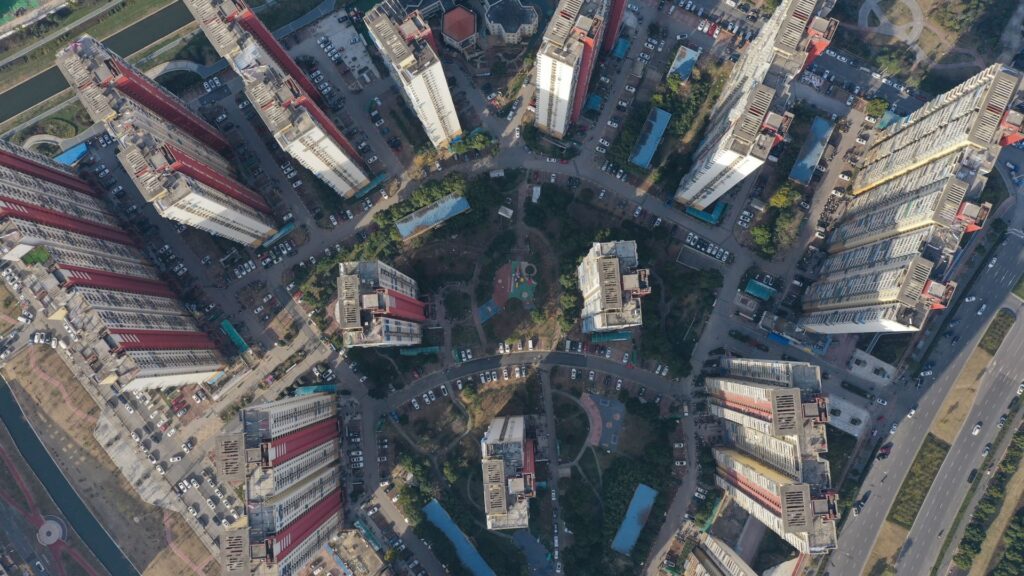

Pictured here is a large residential community in Nanjing, Jiangsu province, Jan. 16, 2023.

Future Publishing | Future Publishing | Getty Images

BEIJING — Debt-heavy local governments in China need new ways to raise money under a central regime that’s made clear its priority is to reduce financial risks.

Local governments’ direct debt exceeded 120% of revenue in 2022, S&P Global Ratings analysts said, noting that’s more than what Beijing has unofficially said was an acceptable debt level.

“The country’s provinces and municipalities have relied heavily on expanded bond issuance to carry them through a COVID-triggered economic slowdown and collapsed land-sale revenues,” the S&P analysts said in a report last month.

International Monetary Fund data show China’s explicit local government debt nearly doubled over five years to the equivalent of $5.14 trillion — or 35.34 trillion yuan — last year. That doesn’t include several other categories of related, rapidly growing debt such as that of “local government financing vehicles” (LGFV) — which allowed regional authorities to tap bank loans for infrastructure projects.

China’s central government is paying attention.

In China’s annual government work report released this month, an entire section was dedicated to preventing and defusing major risks — primarily in real estate and local government debt. “We should … prevent a build-up of new debts while working to reduce existing ones,” the report said regarding local governments’ situation.

The topic didn’t get such prominence in last year’s report, pointed out Ting Lu, chief China economist at Nomura.

“Coupled with the conservative growth target [of around 5%], this may signal a potential shift in focus to tackling financial risks and hidden debt from local governments at some point this year, particularly in H2, after the economic recovery has largely stabilised,” Lu said.

Recent key speeches from Chinese President Xi Jinping have used similar language in calling on…

Read the full article here