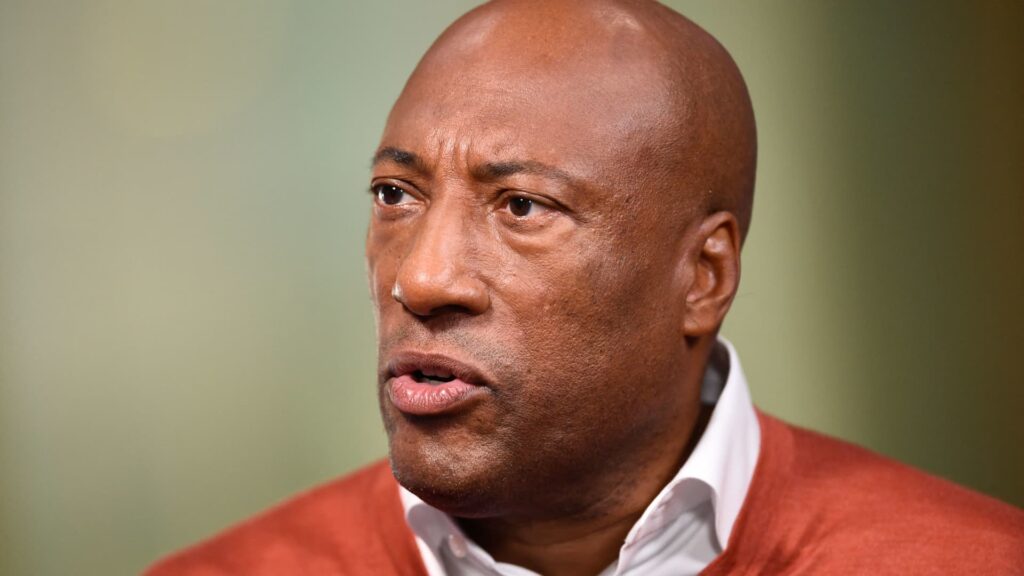

Byron Allen, founder, chairman and CEO of the Allen Media Group, speaks during the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022.

Patrick T. Fallon | AFP | Getty Images

Byron Allen, the media mogul offering $14 billion for Paramount Global, told CNBC on Wednesday that he has the money to finance a deal, despite skepticism around his deal-making.

“We have more than enough capital available to us. The real challenge is certainty of close,” Allen said.

“This deal lives or dies at the [Federal Communications Commission],” he added.

Allen, the founder and CEO of a media group that owns dozens of television networks across the U.S., offered $30 billion for all of Paramount’s outstanding shares, including debt and equity.

The Allen Media Group said in a statement the offer “is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued.”

Allen has a long history of making offers on major media assets. But bidding doesn’t mean buying.

His recent media buyout offers have failed to materialize into sales. The Wall Street Journal reported Wednesday that Allen last year offered $18.5 billion for Paramount, and was rejected.

Allen told CNBC he hasn’t received a response from Paramount to his most recent offer.

Shari Redstone, who controls Paramount through her company National Amusements, has been open to deal-making in recent months in an effort to either merge or sell the company that’s home to brands such as CBS, Showtime, Nickelodeon and its namesake movie studio.

CNBC reported last week that David Ellison’s Skydance Media and its backers were exploring a deal to take Paramount Pictures or the entire media company private.

In December, CNBC also reported Paramount had entered preliminary talks with Warner Bros. Discovery to merge the two media giants in a deal that could have faced regulatory hurdles.

Allen’s bid for Paramount is the most ambitious of the deals the media mogul has tried to…

Read the full article here