Atlanta’s tech scene is rattled but doesn’t appear to be crumbling after the collapse of Silicon Valley Bank over the weekend. That doesn’t mean local tech entrepreneurs aren’t learning lessons.

Why it matters: Losing a key lender, deposit holder and line of credit — run by a bank that thrived on supporting early-stage startups — could have created an existential crisis for local tech companies.

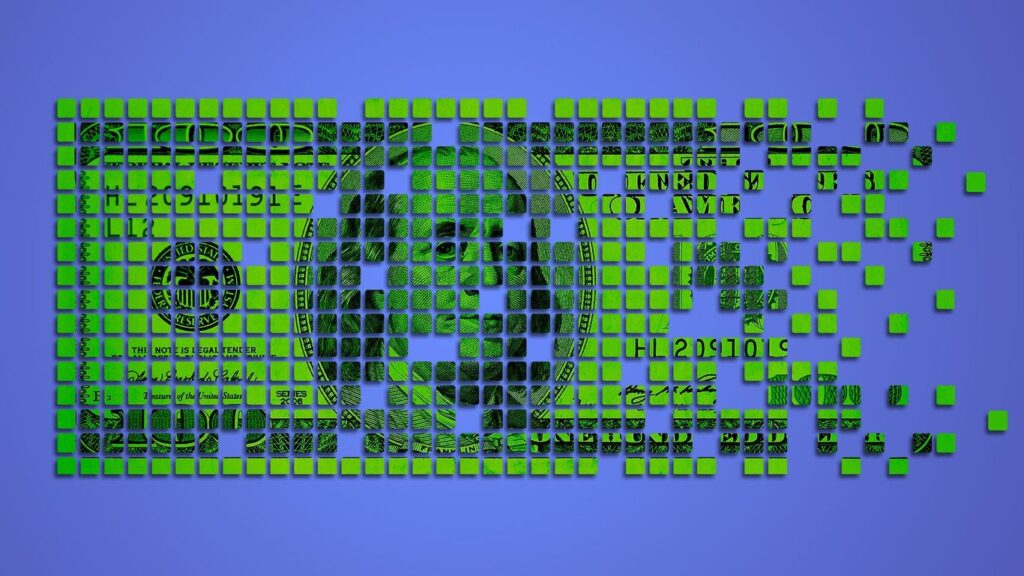

Catch up quick: Federal banking regulators announced Sunday that all of SVB’s depositors would be able to recover all of their money. The FDIC typically insures up to $250,000, and most companies had far more money in their SVB accounts.

- Regulators shut down Signature Bank, a key institution for the cryptocurrency industry, on Sunday, and regional banks like First Republic Bank (San Francisco) and PacWest faced scrutiny from customers and investors, the New York Times reports.

Details: SVB’s collapse was the first “Black Swan” event for young tech executives, Animesh Koratana, the founder and CEO of Atlanta-based startup PlayerZero, told Axios. Himself included.

- Over the weekend, the 23-year-old AI company founder communicated on a 1,500-person group chat where people shared concerns.

- “There would have been a bunch of payrolls that did not complete on the 15th,” he said. “That would be hundreds of thousands of jobs that would be either laid off or furloughed by the end of the week.”

Of note: SVB was the analytics company’s primary bank and starting an account was almost table-stakes for startups, Koratana said.

- “If you’re serious about raising venture money, there’s three things that you’d have to do,” Koratana said. “You have to be a C Corp. It’s got to be in Delaware. And you’re banking in SVB.”

The big picture: Like many Atlanta tech firms, PlayerZero primarily serves other tech companies.

- Koratana wonders how the recent event will change his clients’ behavior and purchasing decisions — particularly during the choppy waters of the economy right now.

What’s next: Sanjay…

Read the full article here