HSBC came to the rescue of Silicon Valley Bank UK in a crucial deal for the whole banking sector. But if you had told its CEO — just a few days beforehand — that this would be happening, he would not have believed you.

“I was going about my normal business on Friday. If somebody had said to me [that] we would be acquiring another bank within two or three days, I wouldn’t have believed it,” Ian Stuart, CEO of HSBC UK Bank, told CNBC’s “Squawk Box Europe” Thursday.

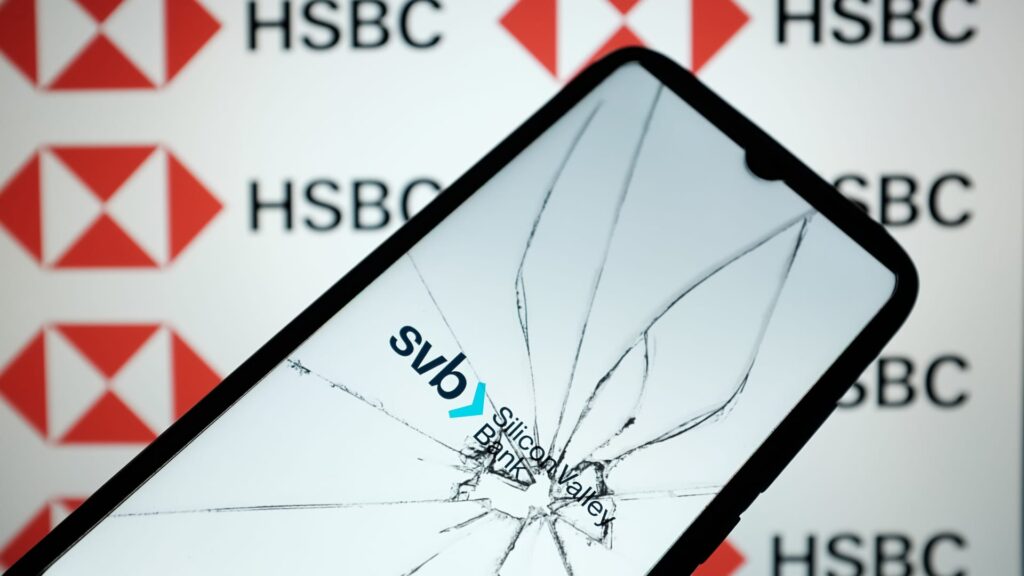

It was all very quick. Silicon Valley Bank — a U.S. lender with clients mostly in the tech and health-care startup world — was deemed insolvent by American regulators on Friday. That raised alarm bells across the pond, where SVB had a subsidiary.

Consequently, the Bank of England announced Friday that, “absent any meaningful further information,” it would be placing Silicon Valley Bank UK into an insolvency procedure.

“Woke up on Saturday morning, saw the announcement and by just after 10:30 a.m. we were in touch with the regulator offering our help, myself and our global CEO Noel Quinn both in contact. And it went a little bit quiet, I think at that point we were just trying to offer any assistance we could,” Stuart said.

More than 200 companies — depositors with SVB UK — wrote Saturday to the U.K.’s Treasury asking for help. They said that some would not be able to comply with payroll deadlines without accessing their deposits with SVB UK.

“We got access to the data bank early on Sunday. We had about five hours to do due diligence and by about 6pm on Sunday — and we had lots of meetings throughout the day — as far as we were concerned it was a competitive situation, and I can honestly tell that even up to about 10, 11 p.m. at night, I still thought it was a competitive situation and around about that time, we were in really close dialogue with the regulator.”

Other financial institutions were also in the mix and assessing the possibility of buying SVB UK, including OakNorth Bank, The Bank…

Read the full article here