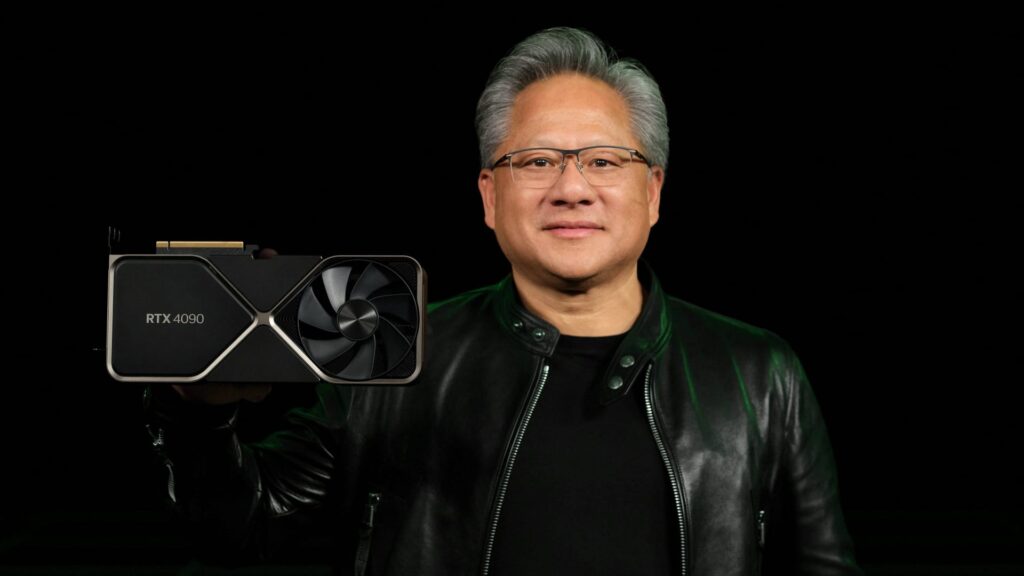

Nvidia Corp CEO Jensen Huang holds one of the company’s new RTX 4090 chips for computer gaming in this undated handout photo provided September 20, 2022.

Nvidia Corp | via Reuters

Nvidia stock rose over 8% in extended trading on Wednesday after the company reported slightly higher revenue and net income than Wall Street expected, despite a year-over-year decrease in both categories. Here’s how the chipmaker did versus Refinitiv consensus expectations for the quarter ending January:

- EPS: $0.88, adjusted, versus expectations of $0.81

- Revenue: $6.05 billion, versus expectations of $6 billion

Nvidia reported $0.57 in GAAP net income per share. Nvidia forecast $6.5 billion in sales in its first quarter, higher than the $6.33 billion expected by Wall Street.

Although both revenue and earnings were down from last year’s $1.32 per share and $7.64 billion in sales, Nvidia has increasingly been seen by investors as one of the chip stocks best positioned to endure an economic slowdown that hurts PC and semiconductor sales.

Nvidia’s data center business, which includes chips for AI, continued to grow, suggested that it could continue to benefit heavily from artificial intelligence software like ChatGPT and Microsoft Bing’s AI chatbot. Nvidia’s graphics processors are well-suited to train and run machine learning software.

The stock was up about 45% in 2023 before Wednesday’s earnings report.

Nvidia CEO Jensen Huang said on a call with analysts that AI is at an “inflection point,” pushing businesses of all sizes to buy Nvidia chips to develop machine learning software.

“Generative AI’s versatility and capability has triggered a sense of urgency at enterprises around the world to develop and deploy AI strategies,” Huang said.

Most of Nvidia’s sales of GPUs for artificial intelligence fall into the company’s data center category. Data center revenue increased 11% on an annual basis to $3.62 billion. The company said the growth was because U.S. cloud service providers bought more…

Read the full article here