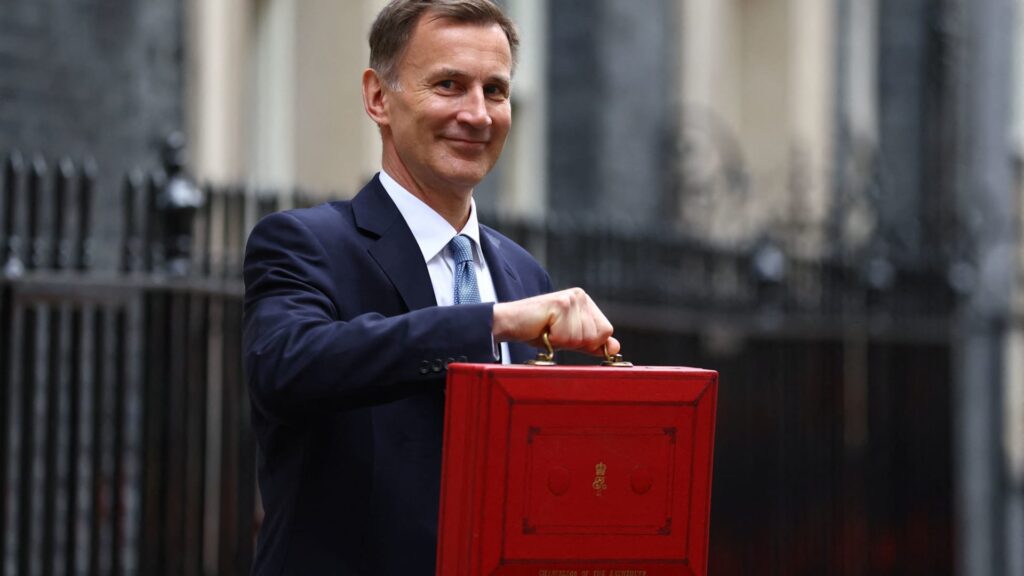

British Finance Minister Jeremy Hunt said earlier this month the U.K. would not enter a recession this year.

Hannah Mckay | Reuters

LONDON — Economists expect U.K. Finance Minister Jeremy Hunt to use a small fiscal windfall to deliver a modest package of tax cuts at his Spring Budget on Wednesday.

Heading into what will likely be the Conservative government’s last fiscal event before the country’s upcoming General Election, Hunt is under pressure to offer a sweetener to voters as his party trails the main opposition Labour Party by more than 20 points across all national polls.

But he must also navigate the constraints of fragile public finances and a stagnant economy that recently entered a modest technical recession.

On the upside, inflation has fallen faster than anticipated and market expectations for interest rates are well below where they were going into Hunt’s Autumn Statement in November.

“On balance, we think Chancellor Hunt’s fiscal headroom will have likely increased – but only marginally, and nowhere close to what he had in the Autumn Statement (owing largely to the fall in expected debt costs),” Deutsche Bank Senior Economist Sanjay Raja said in a research note Thursday.

The German lender estimates that the government’s fiscal headroom will have grown from around £13 billion ($16.46 billion) to around £18.5 billion, and that tax cuts are “very likely” the first port of call. Raja suggested the finance minister will err on the side of caution in loosening fiscal policy, favoring supply side support over boosting demand.

“Supply side measures are more likely in our view, particularly with the Bank of England more amenable to loosening monetary policy,” Raja said.

“Therefore, tax cuts to national insurance contributions (NICs) and changes to child benefits are more likely to come in the Spring Budget (in contrast to earlier expectations of income tax cuts).”

A substantial cut to National Insurance was the highlight of Hunt’s Autumn Statement, though

Read the full article here